The Down Payment Dilemma: How Much Do You Really Need to Buy a Home?

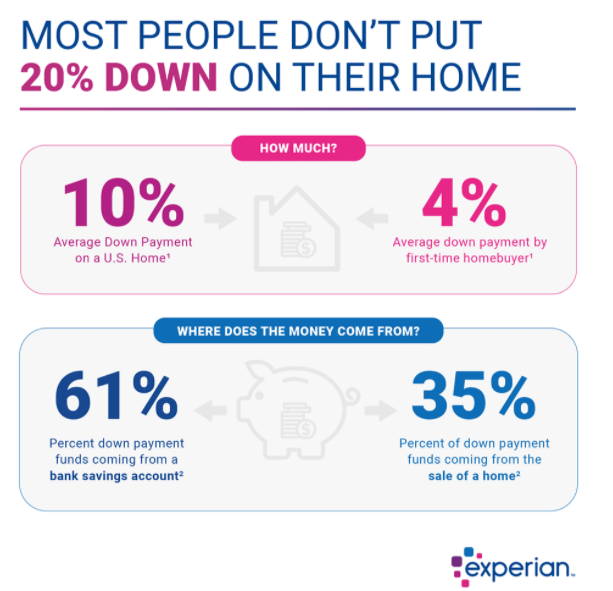

For generations, the 20% down payment has loomed large in the minds of aspiring homeowners. But here’s the truth: that number is often more myth than reality. According to the National Association of Realtors (NAR), the national average down payment hovers around 10%, and for first-time buyers, it’s closer to a surprising 4%. So, what’s the real story?

Dispelling the 20% Myth:

The shift away from the traditional 20% is driven by rising home prices and the explosion of flexible loan programs. Today, lenders understand that every buyer’s situation is unique. But while 20% is ideal, it’s far from mandatory.

What Actually Determines Your Down Payment?

Your credit score and debt-to-income ratio (DTI) are the key players. Lenders use these factors to assess your risk. A higher credit score and lower DTI often open doors to lower down payment options. While traditional loans typically require at least 5%, there are many paths to homeownership with less.

Low Down Payment Options: Your Gateway to Homeownership

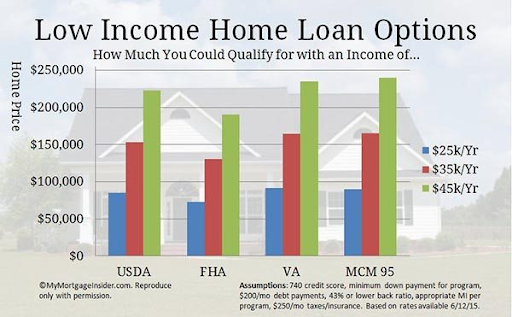

- FHA Loans (3.5% Down): Perfect for first-time buyers and those with less-than-perfect credit (FICO scores as low as 520).

- VA Loans (0% Down): A fantastic benefit for veterans, active-duty service members, and eligible surviving spouses.

- USDA Loans (0% Down): Ideal for rural and suburban areas, offering incredible opportunities for eligible buyers.

- Conventional Loans (3-5% Down): Many lenders offer conventional options with lower down payment requirements, including Fannie Mae’s Conventional 97 (3% down) and HomeReady loans.

- Down Payment Assistance Programs: Over 2,300 programs nationwide offer grants and low-interest loans to qualified buyers.

The Power of Early Lender Consultation:

Before you even start browsing listings, talk to a lender. They’ll help you:

- Determine your affordability range.

- Identify the best loan programs for your unique situation.

- Get pre-approved, making your offers stronger.

- Understand all the costs associated with buying a home, so there are no surprises.

Why 20% Is Still a Smart Move (If Possible):

If you can save 20%, it’s a huge advantage. You’ll:

- Avoid Private Mortgage Insurance (PMI), saving you money each month.

- Enjoy lower monthly mortgage payments.

- Build equity faster.

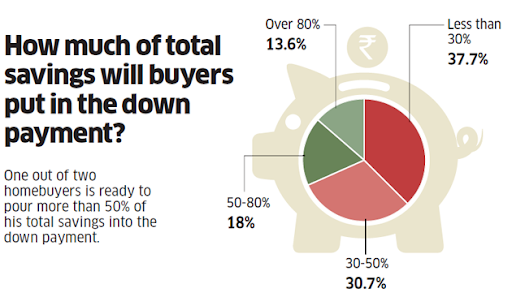

A Word of Caution: Borrowing Your Entire Down Payment:

Borrowing your entire down payment, especially from unsecured sources, is a red flag to lenders. It signals potential financial instability. Remember, homeownership comes with ongoing expenses beyond the mortgage. If you can’t save for the down payment, you might struggle with unexpected repairs or maintenance.

Where Does Down Payment Money Come From?

- 61% – Bank savings accounts.

- 35% – Sale of another home.

- 4% – Gifts from family or friends.

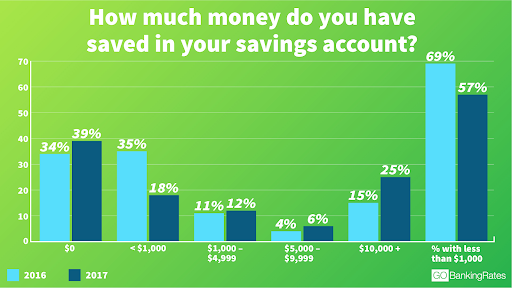

Practical Tips for Saving:

Find the Right Loan: Explore all available loan programs to find one that fits your budget.

Cut Unnecessary Spending: Track your expenses and identify areas where you can trim.

“Pay Yourself First”: Set up automatic deductions from your paycheck to a dedicated savings account or low-risk investment.

Beyond the Down Payment: Prepare for Additional Costs:

Don’t forget about closing costs, home inspections, appraisals, and moving expenses. A good lender will provide a detailed breakdown of these costs.

Your Path to Homeownership Starts Now:

Imagine the feeling of walking into your new home, knowing you’ve made a smart financial decision. By understanding your options and creating a solid savings plan, you can make your dream of homeownership a reality.

Ready to explore your down payment options and take the first step toward your new home? Click here for personalized guidance and the lowest down payment possible for your financial needs.

Jerri McCombs (828)481-8752